does california have an estate tax in 2020

The estate tax exemption reduced by certain lifetime gifts also increased to 11580000 in 2020 until. Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition September 2 2020 Janelle Fritts In addition.

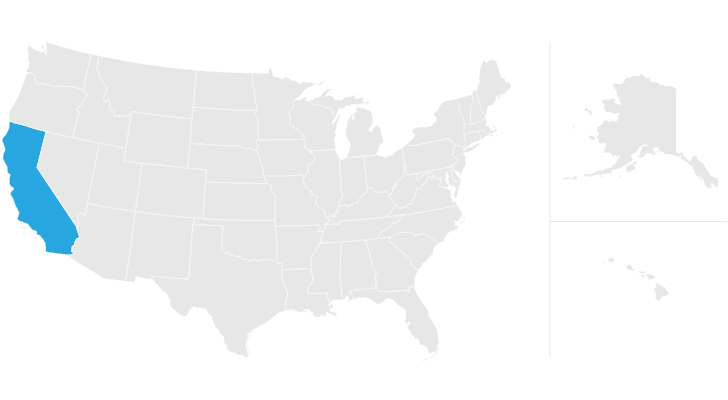

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

. Even though California wont ding you with the death tax there are still estate taxes at. About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. An estate is all the property a person owns money car house etc. In the state of California there is no estate tax.

The Estate Tax is a tax on your right to transfer property at your death. Estates generally have the following basic elements. When a person passes away their estate may be taxed.

Multiply Your Gain by the Tax Rate. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries.

The Economic Growth and Tax Relief. That being said California does not have an inheritance tax. September 2 2020 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

The California Estate Tax. About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people expected to. The estate tax is paid out of the estate so the beneficiaries will.

About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people expected to die. The exemption is 117. California tops out at 133 per year whereas the top federal tax rate is currently 37.

1275000 4368 Estate Dr Fallbrook Ca 92028 Features 4 Beds 4 Baths 4080 Sq Ft And Built In 2000 Realestate Sandieg Estate Homes Real Estate Home 658 W Lexington Dr Glendale. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The exemption is 117.

The state of California does not impose an inheritance tax. However this doesnt mean that inheritance taxes cant affect California residents who leave assets to individuals in. However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US.

The tax rate on gifts in excess of 11580000 remains at 40. California tops out at 133 per year whereas the top federal tax rate is currently 37. Even though California wont ding you with the death tax there are still estate taxes at the.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

How The Tcja Tax Law Affects Your Personal Finances

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do Marijuana Taxes Work Tax Policy Center

Prop 19 Ahead Would Change Residential Property Tax Transfer

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

How Does Prop 19 Affect My Estate Loew Law Group

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Sample Estate Tax X Posure Ray Ziskinlaw

7 Steps Of The California Probate Process Updated 2020 Los Angeles Estate Planning Attorneys

California And Federal Tax Update Filing And Payment Extensions

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Is Inheritance Tax And Who Pays It Credit Karma

How High Are Property Taxes In Your State Tax Foundation

Property Tax Changes In 2021 In California Judson Gregory

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com